5 Key Mortgage Factors to Know when buying a home in Las Vegas or Henderson

Are you planning to buy a home in the Las Vegas Valley? There is a chance that you will need a mortgage to finance the purchase. You can get mortgages from credit unions, banks, or other financial institutions. The fact is that you must meet some basic qualifying criteria before you qualify for a mortgage.

Depending on the lender, there are different requirements that you have to meet to qualify for a mortgage. Apart from that, the type of mortgage that you get depends mainly on the lender you use. Here are five key mortgage factors that you must know:

Your Credit Score

Your borrowing behavior and past payment history determine your credit score. Therefore, your lender checks your credit history when you apply for a mortgage. The first thing a lender will do is to check your credit score. When you have a higher credit score, getting a mortgage with a reasonable interest rate will not be difficult.

Your Debt-to-income Ratio

The Debt-to-income ratio (DTI) is the amount of debt you have compared with your income. This ratio includes your mortgage payment. For you to qualify for a conventional mortgage, your DTI must not be more than 35 percent. Some lenders may allow you to borrow a little more while some may have stricter rules. If you have a massive debt, what you can do is go for a cheaper home with a smaller mortgage or you clear your debt before you consider borrowing for a house.

Your Down Payment

Typically, the lender wants you to have some equity in the home by putting money down. Your investment is to ensure that the lender recovers all the money they have loaned you should you default. Therefore, you are required to put down 20 % of the value of your home and borrow the remaining 80% when buying a house. In some cases, a mortgage requires a 5% down payment, while other mortgage types may permit a 3% down payment for a highly qualified lender.

Your Work History

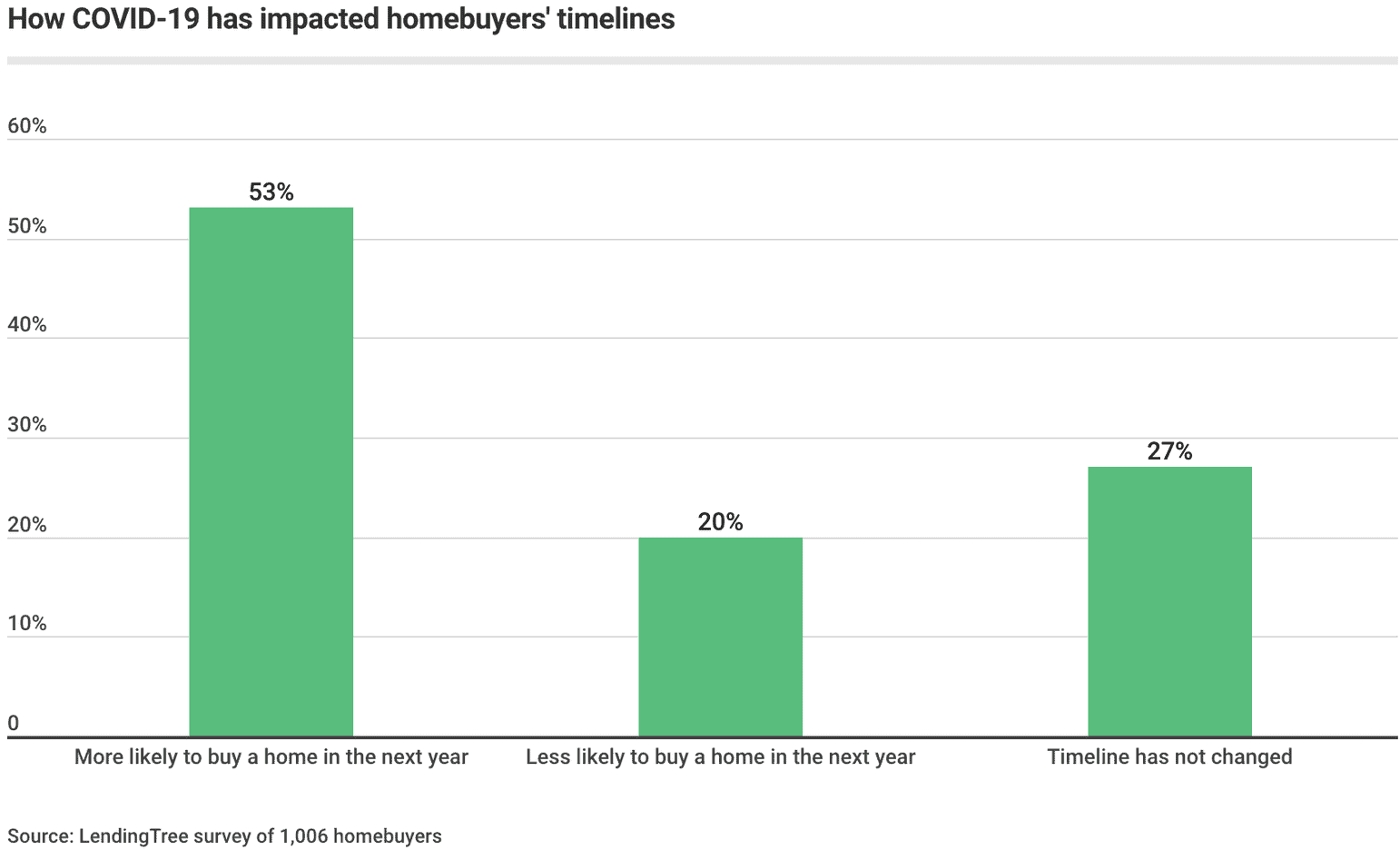

All lenders, irrespective of the type, will demand to see your proof of employment. They check to make sure that you have a stable income and have been working for at least two years. There will of course need to be some flexibility at the moment as some of you may have been laid off due to the COVID-19 business shut downs.

The Value and Condition of the Home

Lenders will be interested to know the value and the condition of the home you are buying to determine if the house is actually worth the amount. A home inspection and home appraisal are needed to make sure the home you are buying is in excellent condition and of good value.

Current Rates

Even though we are going through these horrible times, the rates have never been lower and it is still a good time to buy or sell a home. Please reach out and I have mortgage lenders you can speak to if you have more questions.

Leave A Comment

You must be logged in to post a comment.